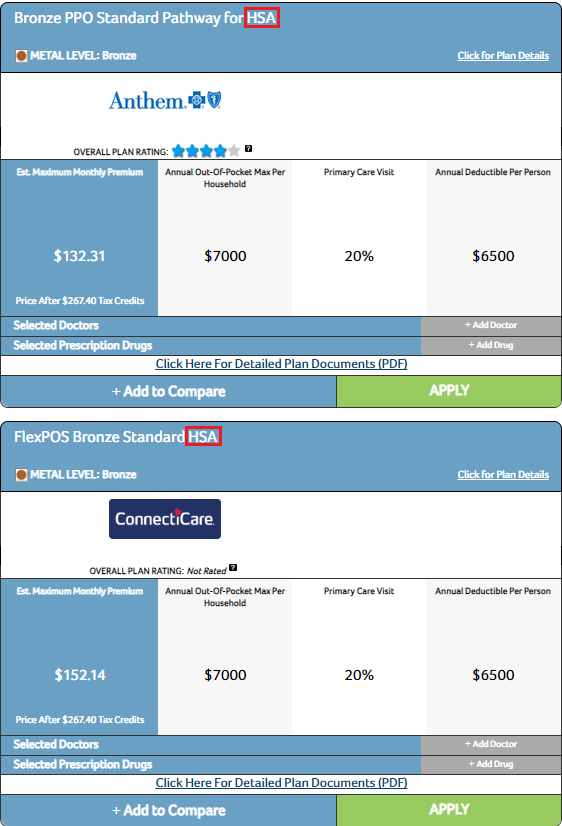

Yes! As a result of the One Big Beautiful Bill, signed into law effective January 1, 2026, all Bronze and *Catastrophic health plans offered through Access Health CT are now Health Savings Account (HSA) eligible.

Funds deposited into a Health Savings Account can be used to cover health care costs, like deductibles, copayments, and coinsurance. Most importantly, contributing to an HSA can also offer a reduction to an individual or family's annual tax burden.

Benefits of an HSA:

- HSA contributions are tax-deductible meaning they reduce your annual taxable income.

- Tax-free withdrawals for qualified medical expenses such as doctor visits, prescription drugs, dental care, and vision care.

- Accumulated amounts roll over year to year (no use it or lose it).

- Funds in the HSA are yours. When you change jobs, your HSA funds travel with you.

- Existing HSAs can be used, or a new account can be established.

What do you need to do:

1. Enroll in a plan that is specifically eligible to be used with a Health Savings Account, like any Bronze or Catastrophic* plan or another Marketplace plan that is designated as eligible for a Health Savings Account.

2. Research and select a financial institution that offers Health Savings Account's. Before selecting an institution, compare the associated fees and investment options.

*Catastrophic plans are available to people under 30 or those over 30 who qualify for hardship or affordability exemptions.

For more information on types of plans available through Access Health CT, click here.